virginia ev tax credit 2020

Either fax your application to 804 367-6379 or mail it to. Several states and local utilities offer electric vehicle and solar incentives for customers often taking the form of a rebate.

/cloudfront-us-east-1.images.arcpublishing.com/gray/6RAFGLSSOZCEJKZY2EA7A74KMQ.PNG)

Money For Electric Vehicle Rebates Appears Unlikely

To begin the federal government is offering several tax incentives for drivers of EVs.

. The base amount of 4000 plus 3500 if the battery pack is at least 40 kilowatt-hours remains the same. This percentage may increase with the number of. And with the Federal Clean Cities initiative you.

Clean Cities Coalitions Virginia is home to the following Clean Cities. DMV Registration Work Center. 2020 to December 31 2022.

See how that works. An enhanced rebate of 2000 would also be available to buyers whose household income is less than 300 percent of current poverty guidelines. Beginning September 1 2021 a qualified resident of the Commonwealth who is.

Download and complete the License Plate Application VSA 10 including the vehicle identification number VIN and title number. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. If you take home a new PEV that meets certain requirements such as battery capacity overall vehicle weight and emission standards you can also receive a federal tax credit of up to 2500.

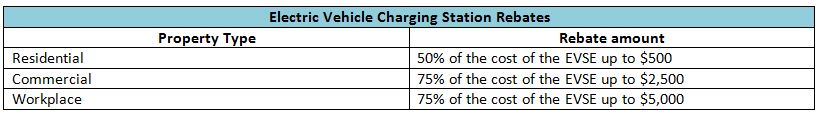

State andor local incentives may also apply. In addition to credits Virginia offers a number of deductions and subtractions from income that may help reduce your tax liability. Permitting and inspection fees are not included in covered expenses.

The credit amount will vary based on the capacity of the battery used to power the vehicle. Review the credits below to see what you may be able to deduct from the tax you owe. Check that your vehicle made the list of qualifying clean fuel vehicles.

Based on your EVs battery capacity and gross weight your credit can range from 2500 to 7500 provided it also has at least five kilowatt-hours of capacity and uses an external. According to Mark Steber chief tax information officer at Jackson Hewitt if we assume only a standard deduction and no other credits a single filer will need an income of. Virginia lawmakers have put forward House Bill 469 which would allow for a 10 State tax refund on the purchase of an electric vehicle up to.

Biodiesel Production Tax Credit. Beginning September 1 2021 a resident of the Commonwealth who is the purchaser of a new or used electric motor vehicle from a participating dealer shall be eligible for a rebate of 2500 subject to the availability of funds in the Fund. However you should be aware of the following requirements.

An earlier version of the budget passed by the. First the amount you receive will depend upon your vehicle. Depending on the vehicle you plan to purchase or currently own there are several federal tax credits that may apply to your situation.

Drive Electric Virginia is a project of. President Bidens EV tax credit builds on top of the existing federal EV incentive. If your solar energy system costs 20000 your federal solar tax credit would be 20000 x 26 5200.

State tax credit equal to 30 of installed cost up to 5000 per property Electric Vehicles. If you install your photovoltaic system in 2020 the federal tax credit is 26 of the cost of your solar panel system. A qualified business creating at least 20 new jobs within three tax years is allowed a credit equal to 20 of its qualified investment.

What States Have EV Incentives. January 1 2023 to December 31 2023. For more information see the Virginia DMV Electric Vehicles website.

1 2022 would offer buyers a 2500 rebate for the purchase of a new or used electric vehicle. Expired Repealed and Archived Laws and Incentives View a list of expired repealed and archived laws and incentives in Virginia. The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles.

To learn more about the Land Preservation Tax Credit see our Land Preservation Tax Credit page. Eligibility for rebate. Small neighborhood electric vehicles do not qualify for this credit but.

EV Charging Equipment Federal Tax Credit up to 1000 Consumers who purchase qualified residential charging equipment prior to December 31 2021 may receive a tax credit of 30 of the cost up to 1000. If you do purchase a full EV model you can potentially receive up to 7500 in federal tax breaks. Points of Contact Get contact information for Clean Cities coalitions or agencies that can help you with clean transportation laws incentives and funding opportunities in Virginia.

The EV rebate program must be operational by December 30 2021. Reference House Bill 717 2020 Electric Vehicle Supply Equipment EVSE Policies for Associations. This credit may range from 2500 to 7500 and is intended to make it more affordable to manage the up-front costs of these vehicles.

Reid D-32nd would have granted a state-tax rebate of up to 3500 to buyers of. On a federal level there is an Alternative Fuel Infrastructure Tax Credit for fueling equipment installed before December 31 2020. On the other hand if you owe the IRS 3000 in taxes and you buy an EV eligible for the full 7500 youll only get a 4500 credit.

In its final form the program which would begin Jan. 10th 2018 330 pm PT. If a single person purchases two eligible plug-in electric vehicles with tax credits up to 7500 for each vehicle they should be able to claim 15000 in.

This is 26 off the entire cost of the system including equipment labor and permitting. A bill proposed in mid-January by Virginia House Delegate David A.

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Rebates And Tax Credits For Electric Vehicle Charging Stations

Virginia State And Federal Tax Credits For Electric Vehicles In Chantilly Va Pohanka Lexus

2022 Ev Tax Credits In Virginia Pohanka Automotive Group

Electric Car Tax Credits What S Available Energysage

How Do Electric Car Tax Credits Work Kelley Blue Book

Latest On Tesla Ev Tax Credit March 2022

Will Tesla Gm And Nissan Get A Second Shot At Ev Tax Credits Extremetech

Local Virginia And Maryland Electric Vehicle Tax Credits And Rebates Easterns

Virginia State And Federal Tax Credits For Electric Vehicles In Chantilly Va Honda Of Chantilly

Virginia State And Federal Tax Credits For Electric Vehicles Pohanka Chevrolet

Virginia State And Federal Tax Credits For Electric Vehicles In Chantilly Va Pohanka Lexus

2022 Ev Tax Credits In Virginia Pohanka Automotive Group

Rebates And Tax Credits For Electric Vehicle Charging Stations

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Roadshow

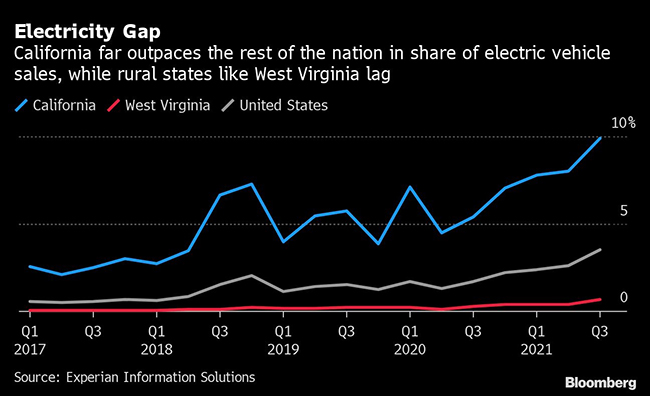

Biden S Ev Plan Faces Jam From Cultural Divide Transport Topics

Virginia Ev Rebate Legislation Proposed In 2021 Pluginsites

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption