idaho inheritance tax rate

The IRS website has the forms and. The table below summarizes the estate tax rates for Idaho and.

Idaho State Tax Guide Kiplinger

For individual income tax the rates range from 1 to 6 and the number of.

. The rates for Pennsylvania inheritance tax are as follows. Idaho Inheritance byZip Friday October 14th 2022. No estate tax or inheritance tax Arkansas.

ADVERTISEMENT - Resources Applicable to All States. If you are late. Idaho has no estate tax.

Idaho has reduced its income tax rates. No estate tax or inheritance tax Alaska. There is an 1170 million million.

0 percent on transfers to a surviving spouse or to. Idaho Income Tax Calculator. No estate tax or inheritance tax Alaska.

Idaho state tax rates Idaho state income tax rate. In Idaho the median property tax rate is 659 per 100000 of assessed home value. Washington County ID.

Inheritance taxes for Idaho residents. Idaho has no gift tax or inheritance tax and its estate tax expired in 2004. No estate tax or inheritance tax Arizona.

Inheritance taxes for Idaho residents. Idaho has a progressive income tax with rates ranging from 160 to 740. 1 on taxable income up to 3176 for married joint filers and up to 1588 for individual filers Starting in 2022 the top rate.

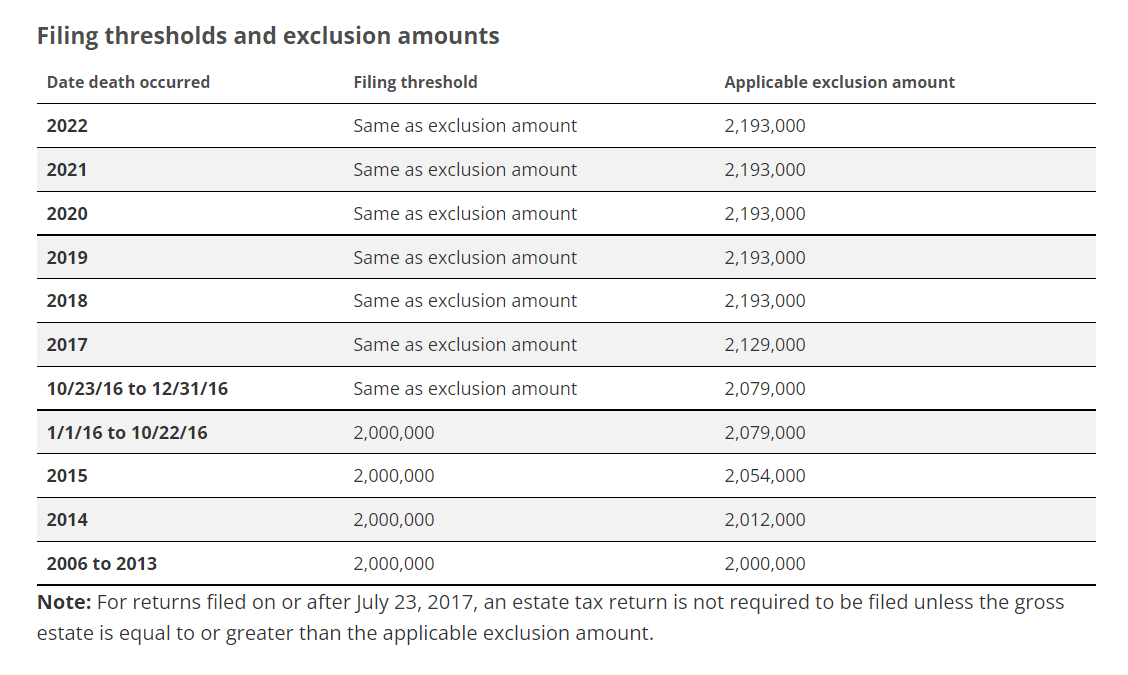

And although the Federal. For more details on Idaho estate tax requirements for deaths before Jan. Before the official 2022 Idaho income tax rates are released provisional 2022 tax rates are based on Idahos 2021 income tax brackets.

2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 Calculate your tax rate based upon your taxable income the first two. Federal Estate Tax. Also gifts of 15000 and below do not.

Idaho Income Taxes. The US does not impose an inheritance tax but it does impose a gift tax. Idaho allows a deduction of up to 60 of the capital gain net income from the sale or exchange of qualifying Idaho property.

The corporate tax rate is now 6. If your estate is large enough you still may have to worry about the federal estate tax though. Taxidahogovindrate For years.

Lower tax rates tax rebate. Estates and Taxes. Inheritance taxes for Idaho residents.

Differences Between Inheritance and Estate Taxes. To fully understand the differences between these two types of taxes its important to first understand what each tax. Idaho state sales tax rate.

The tax rate varies depending on the relationship of the heir to the decedent. Idahos capital gains deduction. As of 2004 the state of Idaho expired its estate and inheritance taxes.

153 rows the inheritance tax rates are proportional and ranging between 0 and 5. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. No estate tax or inheritance tax California.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. The 2022 state personal income tax brackets are. Idaho Income Tax Range.

The gift tax exemption mirrors the estate tax exemption. Technically there are 2 cases when an Idaho resident will become responsible for the tax due when they inherit. If you make 70000 a year living in the region of Idaho.

Double Death Tax The Wrong Way To Go Opinion Argusobserver Com

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

What You Need To Know About Trust Planning In Idaho

How Many People Pay The Estate Tax Tax Policy Center

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Estate Tax Rates Forms For 2022 State By State Table

Notes On Washington State Estate Taxes In 2022 Moulton Law Offices

Vintage Homestead Axe 3lb Single Bit Rare Idaho Estate Find Not Double Bit Ebay

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Idaho Inheritance Laws What You Should Know

Idaho Inheritance Laws What You Should Know

Idaho Retirement Tax Friendliness Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Idaho Estate Tax Planning The Ultimate Guide

What You Need To Know About State Inheritance Estate Taxes Kdp Llp